56% of Canadians concerned banking system is vulnerable to collapse: survey

Key findings

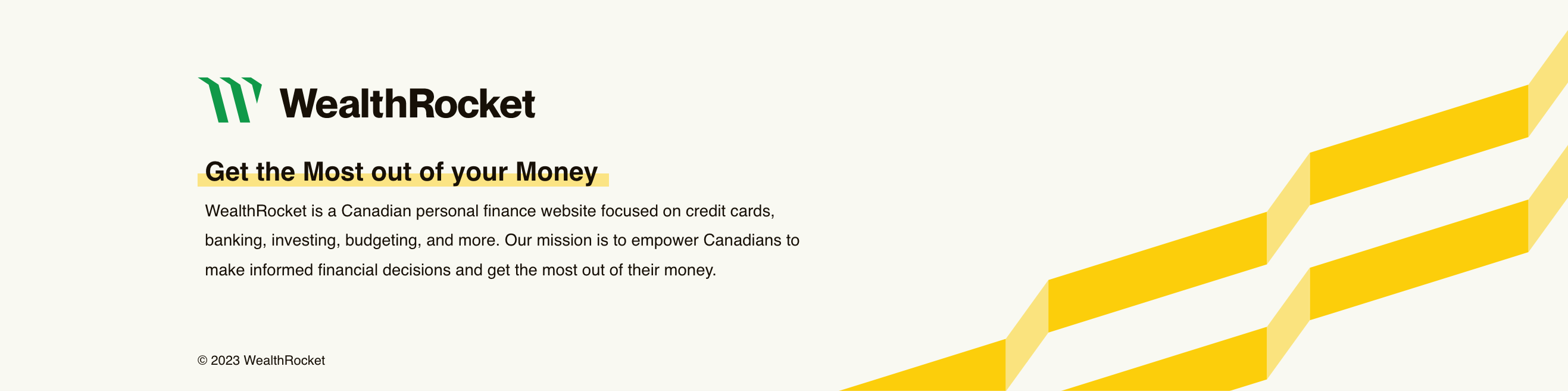

of Canadians are concerned that Canada’s banking system is vulnerable to collapse, similar to what’s happened with some banks in the U.S. and Europe.

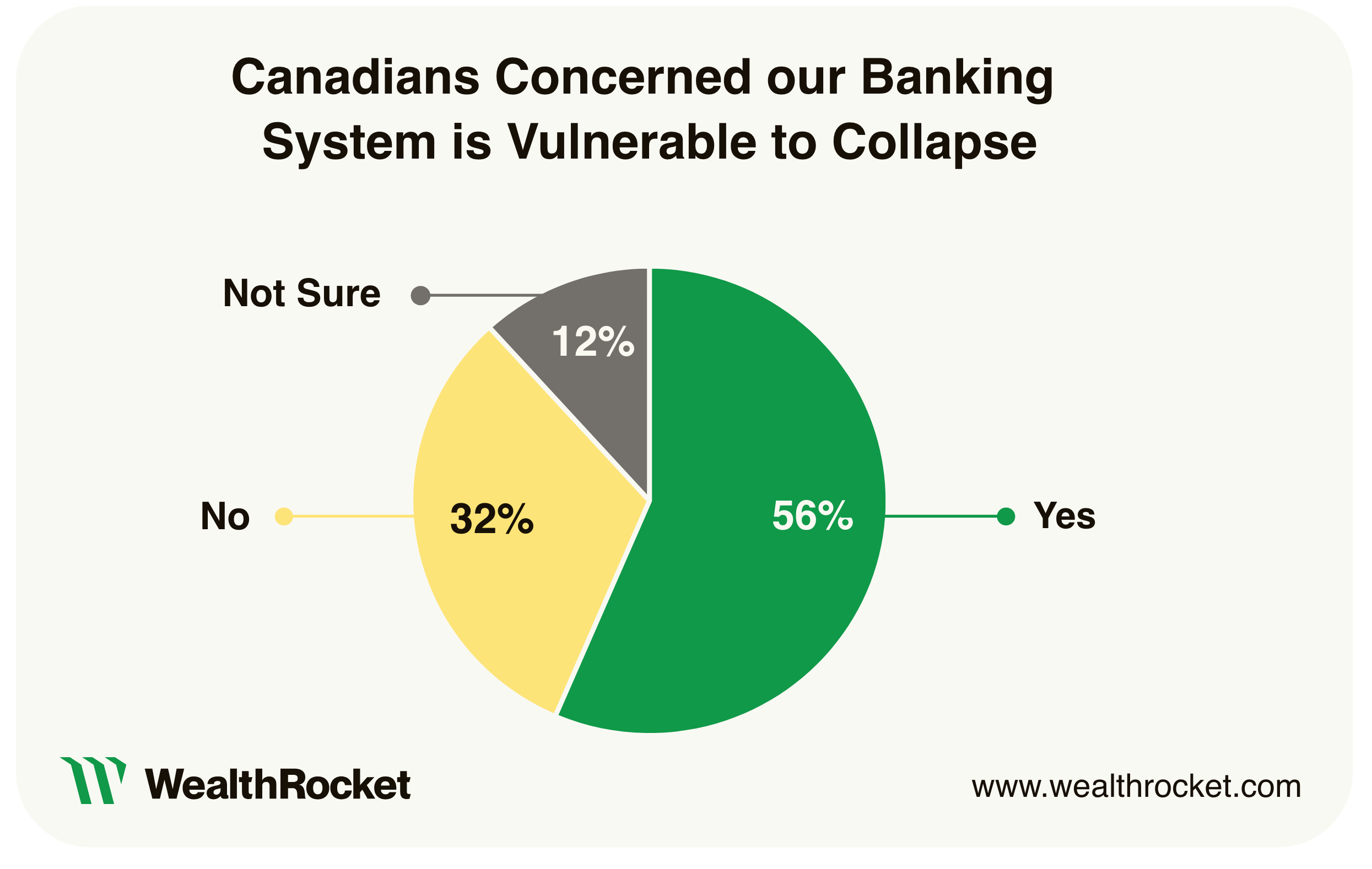

of Canadians are somewhat worried about the safety and security of their deposits in a Canadian bank.

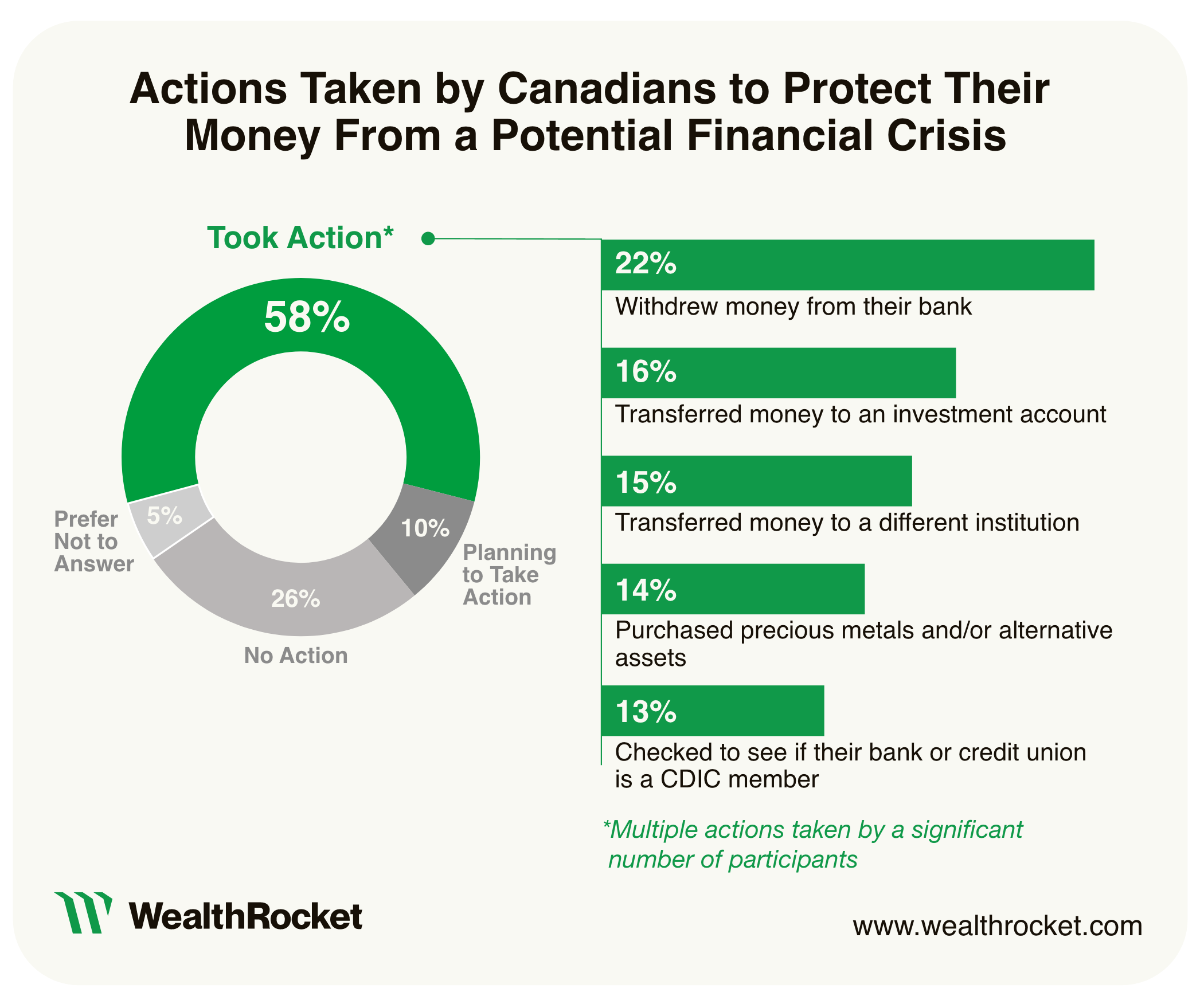

of Canadians have withdrawn money from their bank account in the last 30 days to protect from a potential financial crisis; 15% have transferred their money to a different institution; and 14% have purchased alternative assets, like cryptocurrency.

When Silicon Valley Bank (SVB) collapsed in March after a panic-induced run on deposits, it marked the second-largest bank failure in America’s history. Two days later, the New York State Department of Financial Services shuttered Signature Bank after a “crisis of confidence” in leadership. And a couple weeks after that, a Swiss bank collapse was narrowly avoided when the federal government bailed out troubled lender Credit Suisse — a move that’s costing Swiss taxpayers the equivalent of US$13,500 each but regulators argue was necessary to prevent a full-scale bank run in Switzerland.

These events have spurred a lot of chatter about the potential for a global banking crisis and the resiliency of other countries’ banking systems. Financial contagion, after all, is a real phenomenon that can spread like wildfire and topple economies.

While it appears to be contained for now, Canadians may understandably have questions about the fate of their deposits here at home. In fact, a new WealthRocket survey reveals that 28% of Canadians are somewhat worried about the safety and security of their money in a Canadian bank, and 56% are concerned that our banking system is vulnerable to a crash.

More than half of Canadians concerned about vulnerability of our banking system, with millennials most worried

According to the survey results, 56% of Canadians are concerned that Canada’s banking system is vulnerable to collapse, similar to what’s played out with some financial institutions in the U.S. and Europe.

“This does not surprise me in the sense that there's a lot of fear and panic going around,” says David-Alexandre Brassard, chief economist at Chartered Professional Accountants Canada.

“Information is less differentiated geographically than it used to be. We get a lot of our information from the web and see a lot of news from the U.S. and Europe. So, I would expect that to colour people’s impressions.”

Out of all age groups surveyed, millennials appear to be most worried. Those ages 35-44 expressed the most concern (64%) about the vulnerability of Canada’s banking system, followed by those 25-34 (63%), 18-24 (51%), 45-54 (51%) and 54+ (45%).

28% of Canadians worried about the safety and security of their deposits

More than a quarter (28%) of Canadians report feeling somewhat worried about the safety of their deposits in a Canadian bank right now, with 20% very worried, 9% extremely worried, 24% neutral, and 19% not worried at all.

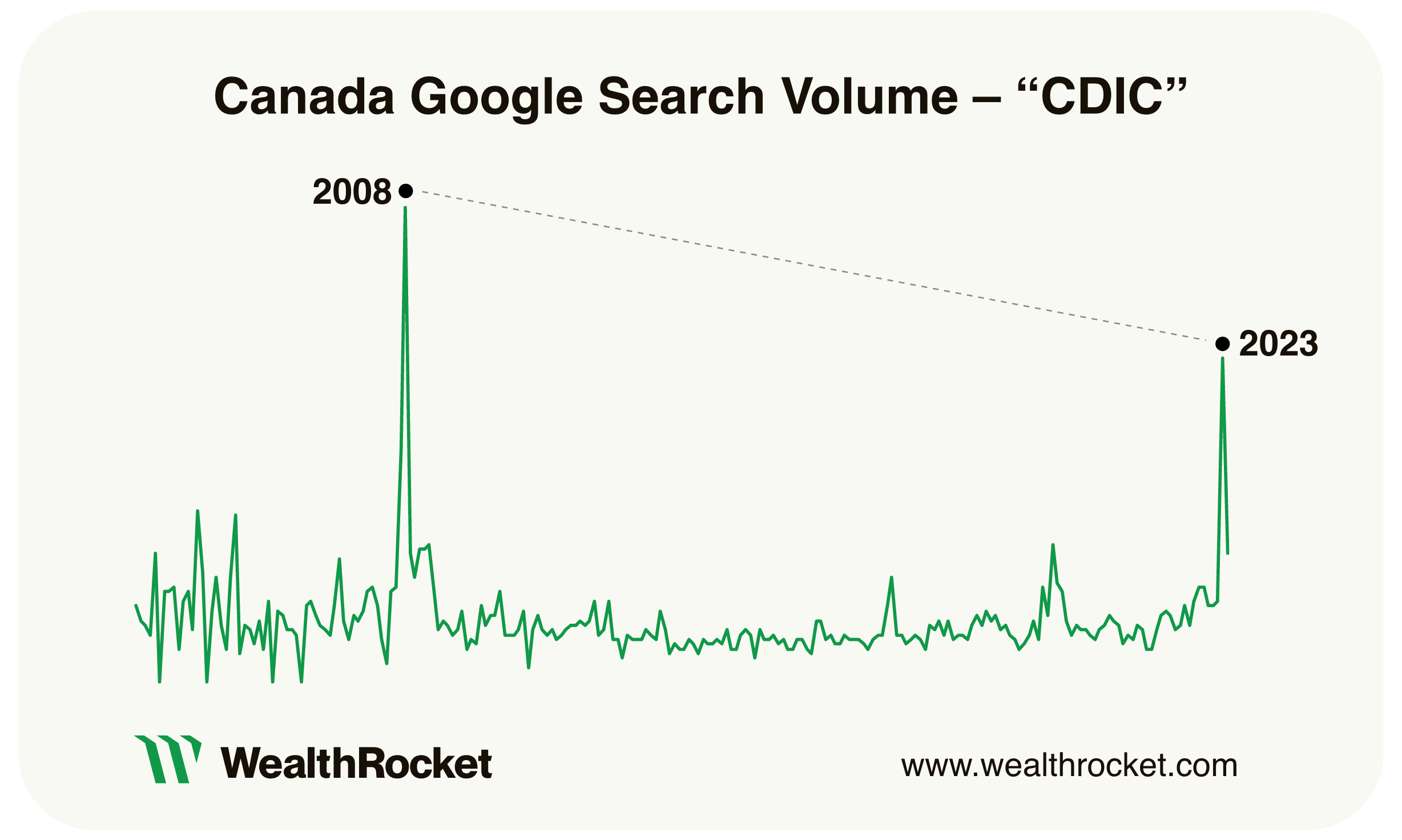

The other reassurance? There are federal protections in place in Canada for consumer deposits via the Canada Deposit Insurance Corporation (CDIC). Prior to the SVB collapse, it’s possible Canadians didn’t pay much mind to the concept of deposit insurance, but it’s important to understand what it is and how it works.

CDIC: do Canadians understand how their deposits are protected?

The financial institution you choose to bank with determines whether your deposits are insured. How much money is insured in a bank account in Canada? Well, if your financial institution is a CDIC member, you automatically have deposit protection up to $100,000 per eligible account.

“For most people,” says Brassard, “the cash they have outside of their investment accounts would probably be a little under that.” In the wake of SVB, there have been calls from advocacy groups to increase the CDIC coverage limit, considering the U.S. limit amounts to roughly $340,000 CAD.

Our survey results reveal that 37% of Canadians know what CDIC protection is and know their financial institution is a member. Slightly less (32%) don’t know what CDIC is and have no idea if their financial institution is a member.

CDIC coverage is free to Canadians. Member institutions pay for the insurance in the form of premiums. But not all financial institutions are CDIC members by default, so it’s worth checking to see if yours is. According to our survey results, 13% of Canadians have checked in the last 30 days to see if their bank is a CDIC member. (You can do this by visiting the CDIC members page on its website.)

In the wake of the SVB collapse and the Credit Suisse bailout, the CDIC says it saw an uptick in consumer inquiries.

“As a result of financial news coming from the United States and Europe, an increasing number of Canadians reached out to CDIC’s call centre and visited CDIC’s website,” Mathieu Larocque, CDIC spokesperson, said via email.

“In March, CDIC also amplified its public advertising on top of ongoing efforts to keep Canadians informed through CDIC’s website and other public information channels,” Larocque said. “Canadians who are informed about CDIC’s protection are more likely to be confident in the safety of their savings.”

If you bank with a credit union, which more than 10 million Canadians do, you’ll have different protection than CDIC. Credit unions in Ontario, for instance, are insured by the Deposit Insurance Reserve Fund (DIRF), which is administered by Ontario’s financial regulatory body, FSRA, and are insured up to $250,000 per eligible account.

Canadians taking action to protect their money from potential crisis

Despite no concrete threat on the horizon, Canadians are taking steps to protect their money from a potential financial crisis. For instance, 22% of Canadians say they’ve withdrawn money from their bank account in the last 30 days; 16% have transferred their money to an investment account; 15% have transferred their money to a different institution; and 14% have purchased alternative assets, like cryptocurrency.

While we don’t know in what amounts Canadians have withdrawn money, it’s clear that at least some feel compelled to have cash that’s easy to access. And while we don’t know for sure that those who transferred their money to a different institution did so because of CDIC eligibility, it’s one possible reason.

Canadians could also be trying to diversify their accounts, which isn’t a bad idea. Because CDIC only covers deposits up to $100,000 per eligible account, Canadians can maximize their coverage by spreading their savings across multiple accounts and/or CDIC-insured institutions. The same goes for transferring money to an investment account, such as an RRSP or TFSA. Investments are insured by something called the Canadian Investor Protection Fund, which protects lost investments in the event of a firm insolvency, up to $1 million.

History of U.S. vs. Canada bank failures

For those concerned about the resiliency of the Canadian banking system or worried about a financial crisis in Canada, it can help to look at historical data.

The last time a Canadian bank failed was in 1996, when roughly 2,600 Canadians lost a total of $42 million in deposits with Security Home Mortgage Corporation, based in Calgary. Since then, however, Canada has had zero banking failures, while the U.S. has had hundreds.

According to Brassard, the key differences between our two banking systems comes down to market share, asset diversification, and liquidity. There are 34 domestic banks in Canada compared with more than 7,000 in the U.S. This means more stability, tighter oversight, and an overall easier job for Canadian financial regulators to spot trouble. Canada has far fewer regional banks, and only six major ones — often referred to as the “Big Six.”

- Royal Bank of Canada

- Scotiabank

- Bank of Montreal

- CIBC

- TD Bank

- National Bank

Canada’s banks have very diversified portfolios, too, which insulates them well from issues in other markets. They’re also recognized internationally for being well-capitalized and well-positioned to manage severe macrofinancial shocks.

There’s a trade-off Canadians make for all this stability, though: higher banking fees. While fewer banks make regulation easier, that also means there is less competition, making banking more expensive for consumers. “It's the Canadian way,” says Brassard. “That's what we've chosen to do in many sectors.”

Canadians may also start to notice tighter lending requirements as banks get even more serious about having adequate capital on hand and try to limit their exposure to the U.S. economy.

How likely is a banking crisis in Canada?

While Canadians can take steps to insure their deposits are safe, the bulk of financial crisis prevention comes via regulation. In Canada, banks (and some credit unions) are regulated by the Office of the Superintendent of Financial Institutions (OSFI).

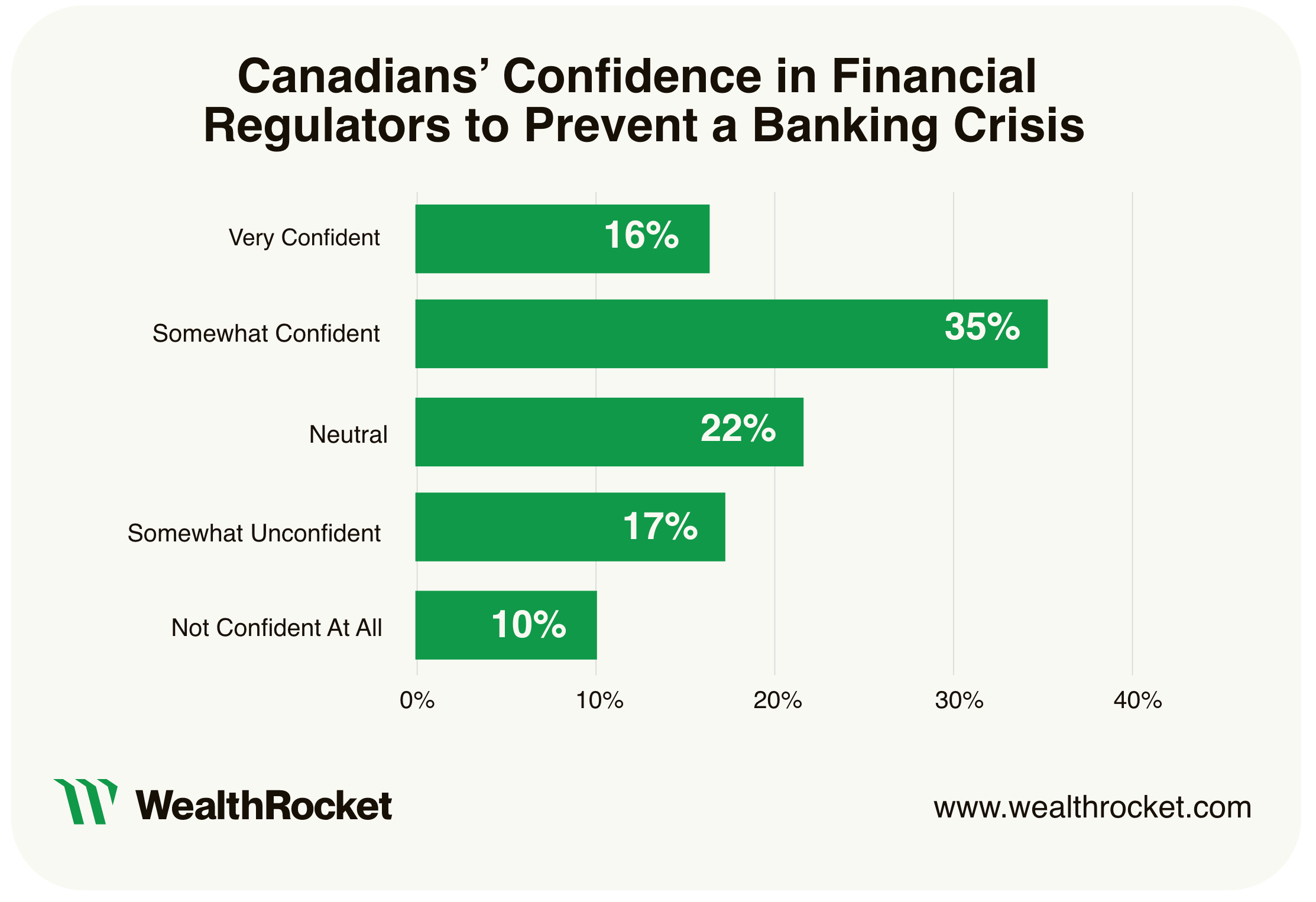

According to the survey results, 35% of Canadians are somewhat confident in the ability of government and financial regulators to prevent a national banking crisis, with only 10% saying they’re not confident at all.

While the Canadian banking system is tightly regulated, no system is infallible. Bank of Canada (BoC) governor, Tiff Macklem, recently warned that Canada is not immune to banking instability. “The financial system, like the rest of the economy, has to adjust to higher interest rates and we do need to be ready for the possibility that there could be some issues,” he said at the International Monetary Fund’s spring meeting in Washington, D.C. on April 13. “We do need to be vigilant.”

In March, the BoC said it’s prepared to act if any signs of market-wide banking stress appear. For now, though, that “if” appears to be a reliable one.

“Canadian banks are some of the most profitable in the entire world,” says Brassard. “They’re not in an uncomfortable financial situation.”

If signs of a banking crisis ever did start to emerge, Canadians can be assured that the alarm will be sounded swiftly. “It’s important to keep in mind that regulators are watching closely,” says Brassard, pointing to how quickly OSFI rescued the Canadian branch of SVB in March.

“Spotting a bad apple when you've got six banks is not hard,” he says. “If one of them is going astray, you'll see it quite fast.”

Methodology

Data was collected via an online Pollfish survey of 1,500 Canadians ages 18 and older conducted between April 13 and 14, 2023. The estimated margin of error for a survey of this size is +/- 3%.

Fair Use Statement

If you enjoyed our study on Canadian banking crisis fears, feel free to share it for non-commercial use. We ask that you link back to the original page so our editorial team receives credit for their work.

Inquiries