59% of Canadians willing to use a central bank digital currency, but many have concerns: survey

Key findings

of Canadians are willing, to varying degrees, to use a central bank digital currency (CBDC) if one ever becomes available, and 25% would use it in place of cash.

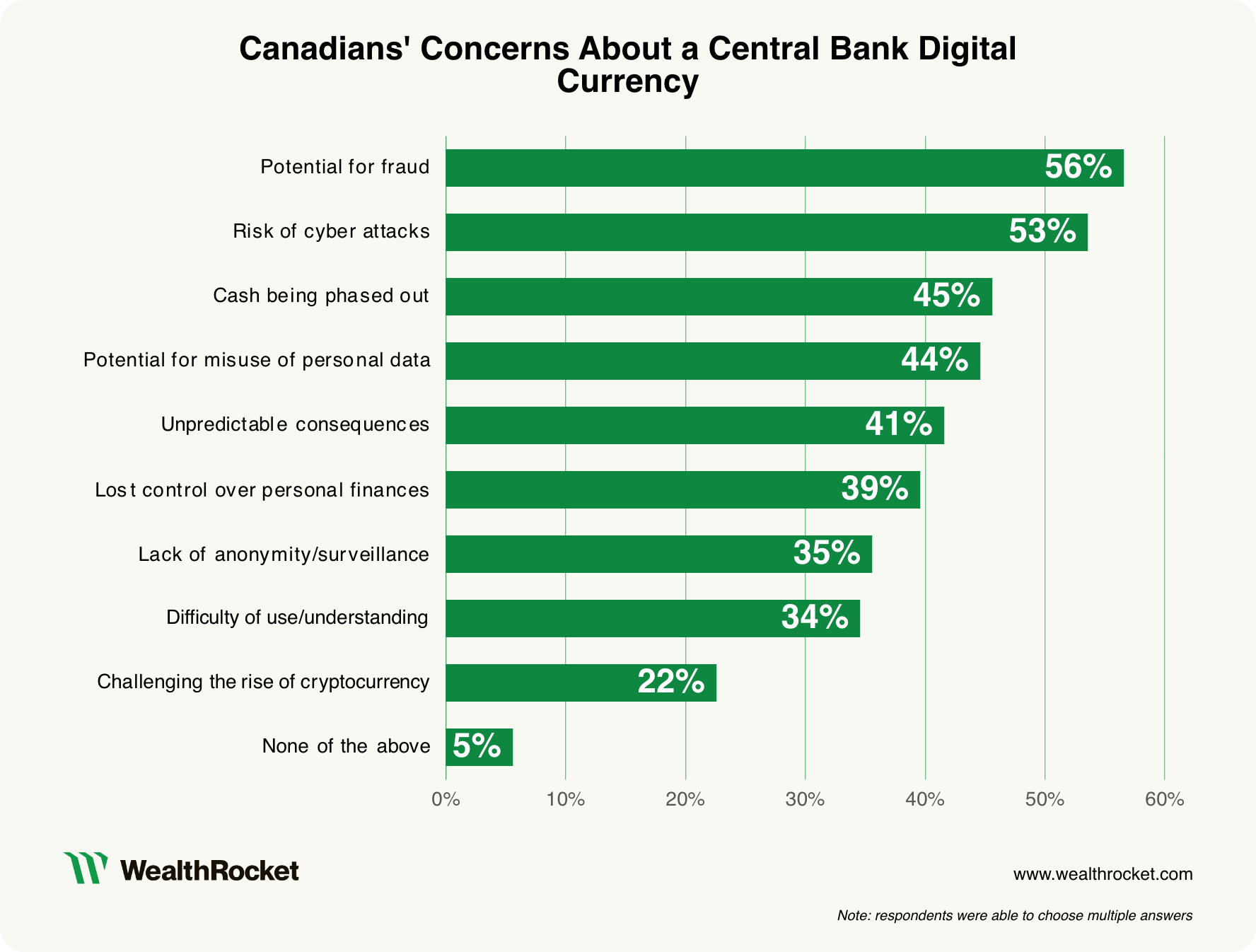

of Canadians are concerned about the potential for fraud with a CBDC, as well as the risk of cyber attacks (53%), potential misuse of personal data (44%), and lack of anonymity with transactions (35%).

of Canadians are somewhat confident in the Bank of Canada to safeguard their privacy if a CBDC is implemented, while 25% aren’t confident at all.

The Bank of Canada (BoC) launched a public consultation last month around a central bank digital currency (CBDC). While there are no immediate plans to implement a CBDC in Canada, the Bank is preparing for the possibility that one day Parliament may ask it to create one.

The consultation, which ran until June 19, asked Canadians many questions, including how they currently make day-to-day transactions, in what ways they would or would not use a CBDC, and whether they trust the government and other institutions to safeguard their data.

This might be the first time many Canadians are hearing about a government-issued digital currency, but the concept isn’t new. Canada is one of about 100 countries currently exploring the potential for a CBDC, and 18 of the world’s G20 countries are in the pilot stages of development.

What is a CBDC?

There are many misconceptions about what a CBDC is. It’s not the same as cryptocurrencies (these are speculative assets in the private sector more suitable for investments). And it’s not the same as the electronic funds you use when you pay with a credit card. The key distinction comes down to who is issuing the money.

“Most of the digital currency that we work with — our credit and debit cards, our app payment systems — these are electronic forms of money, but they’re issued by commercial banks,” explains Trevor Tombe, professor of economics at the University of Calgary.

A CBDC, on the other hand, is an electronic form of cash issued directly by the central bank. “The Bank of Canada issues electronic currencies already, but it issues them to banks, not people,” says Tombe. These are called settlement balances.

Only the largest financial institutions, and the federal government, have direct accounts with the BoC. A CBDC would broaden this access to the public. “It would be like opening a bank account at the central bank,” says Tombe. “But you wouldn't need to have Bank of Canada branches popping up all over the place in order to conduct transactions. It could all be done through some kind of app.”

A digital currency in Canada would hold the same value as our physical cash. And it could be designed and programmed to function in different ways according to the country’s needs, whether it comes to privacy, security, or usage.

59% of Canadians willing to use a digital currency; a quarter would use in place of cash

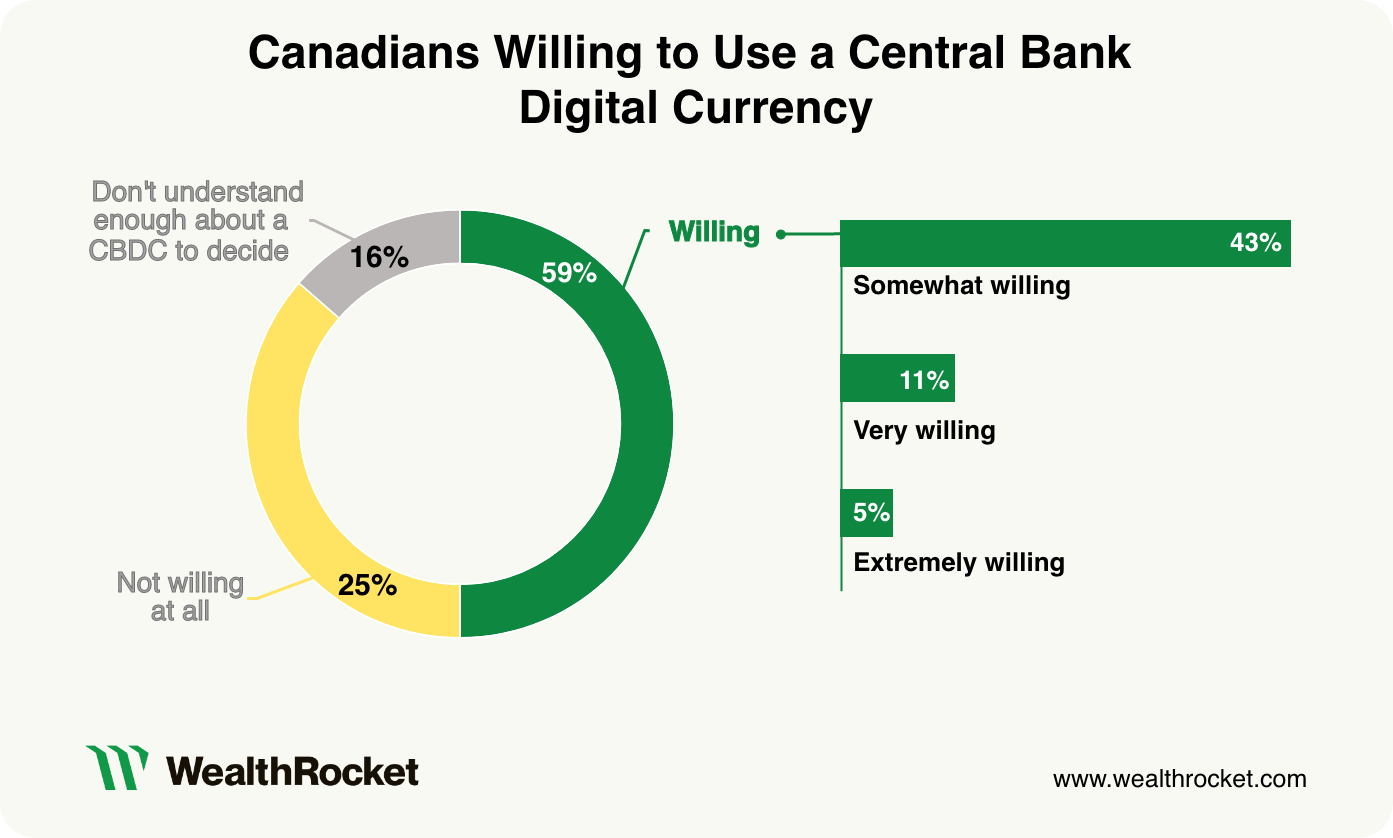

According to the survey results, more than half of Canadians (59%) say they’re willing, to varying degrees, to use a CBDC. Of that total, 43% are somewhat willing, 11% are very willing, and 5% are extremely willing.

A quarter of respondents, on the other hand, say they're not at all willing to use a central bank digital currency in Canada. And 16% say they don’t understand enough to make a decision right now, suggesting a gap in public awareness.

“We need to prioritize education in a way that is slow, methodical, and transparent,” says Jennifer Lassiter, executive director of The Digital Dollar Project, a U.S.-based nonprofit devoted to catalyzing private sector research and exploration of a CBDC in the U.S.

She believes this should be done via public-private partnerships; more specifically, leaning on private sector resources, design, and knowledge, and then building the system using public infrastructure. “There will be tension, as there always is between the regulator and the regulated. But I think that is very healthy tension.”

Part of the awareness gap may include the question of what happens to our physical cash if a CBDC is created. In fact, 45% of Canadians expressed concern that a CBDC could result in cash being phased out. Given the rise of digital payments over the last decade, it’s an important question to ask.

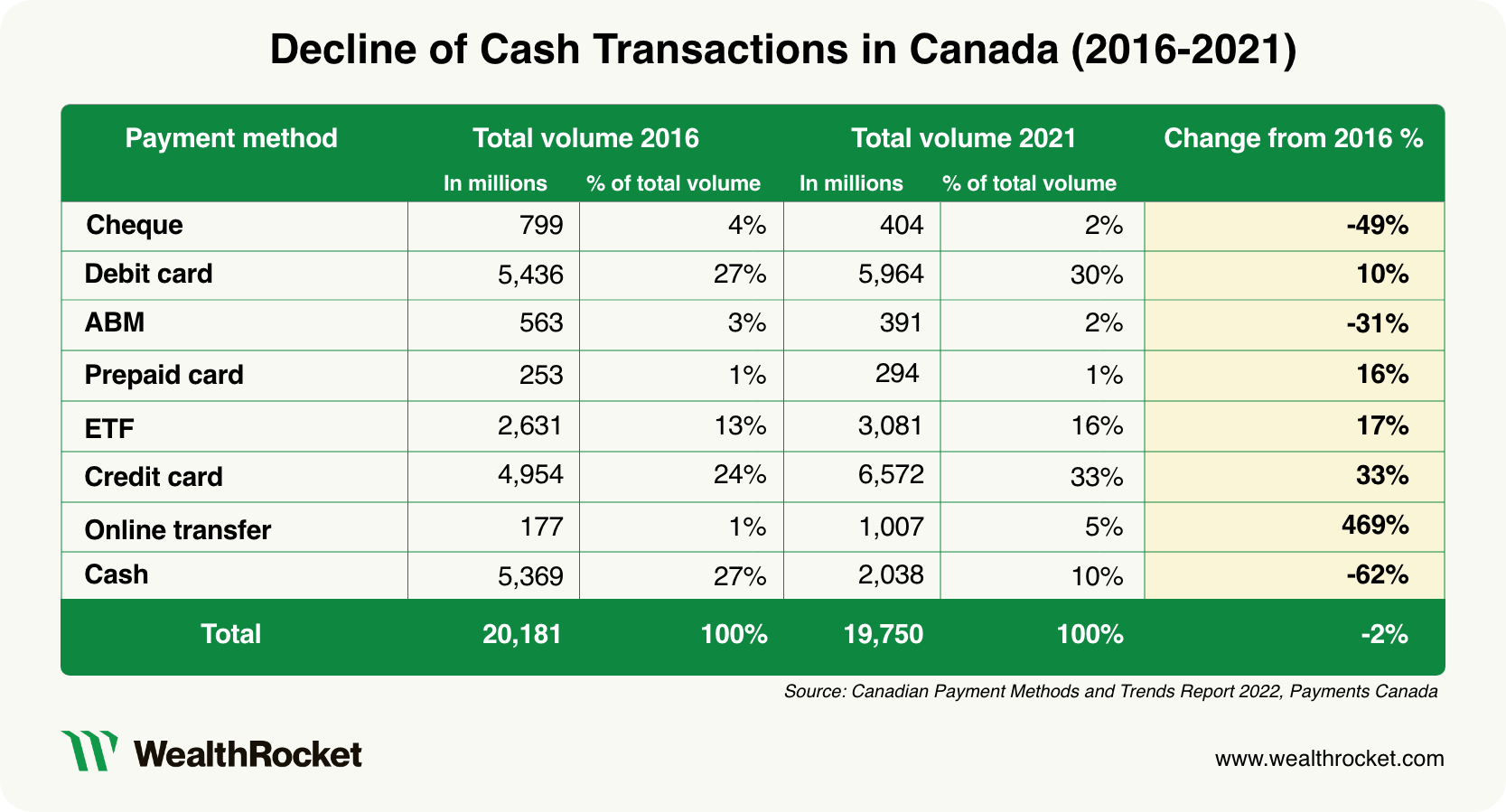

According to recent data from Payments Canada, a not-for-profit delegated by the government to clear and settle payments, cash transactions declined by 62% from 2016 to 2021. That same year, cash made up only 10% of the total volume of payment transactions in Canada. This is compared with 30% and 33% for debit and credit card transactions, respectively.

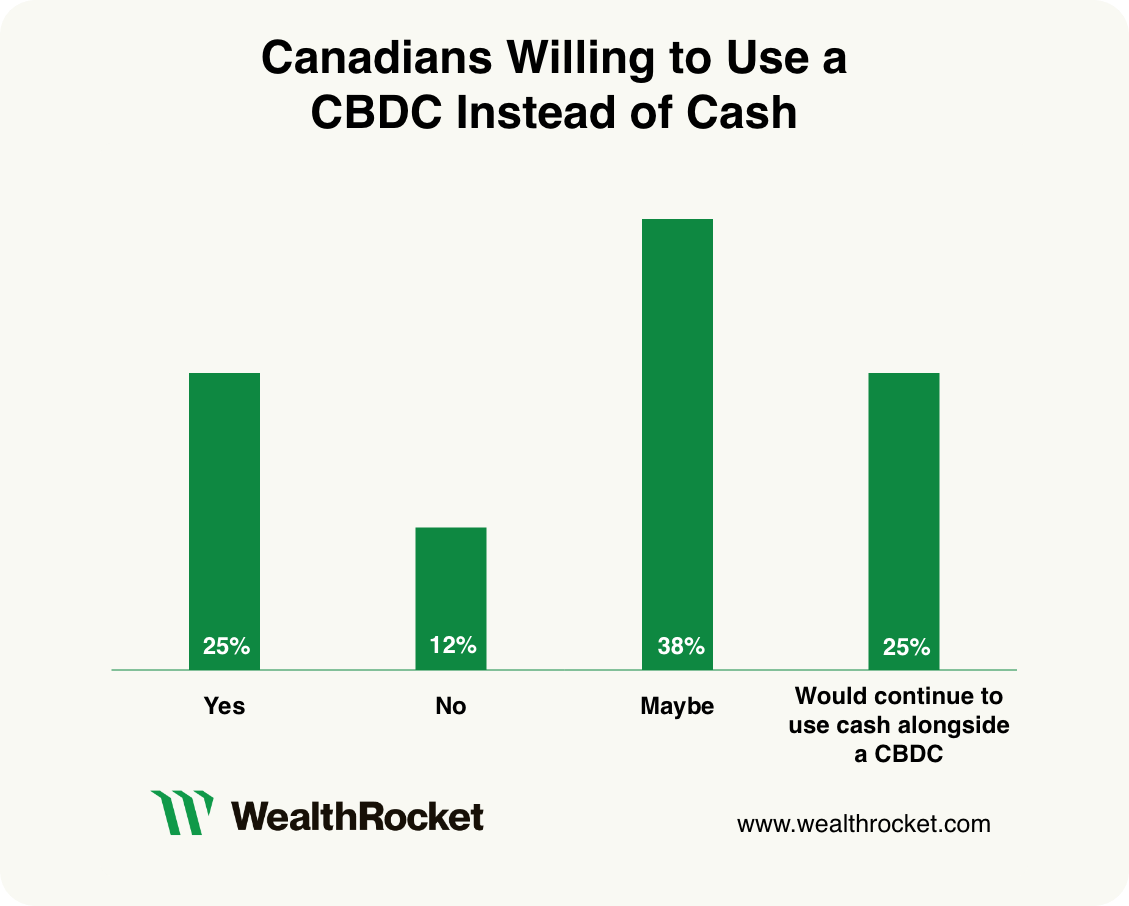

The BoC maintains that cash isn’t going anywhere. A CBDC would simply exist alongside our bills and coins. When respondents were asked if they would use a CBDC in place of cash, 38% said maybe, a quarter (25%) said yes; 12% said no; and 25% said they’d continue using cash alongside a CBDC.

“It's natural that as technology advances, the way we pay [for things] advances, too,” says Dr. Ori Freiman, a post-doctoral fellow at McMaster University's Digital Society Lab. “We already see cashless societies around the world, or many going that way. But if we have a digital Canadian dollar issued by the central bank, we'll have to make sure an alternative exists. And that alternative is physical cash.”

Freiman’s concern is that when businesses go cashless, it forces consumers to use a third party, which opens them up to a lack of anonymity in their transactions. It also means they have to trust payment apps and infrastructure to protect their personal data. With cash, there are no such vulnerabilities.

But is the disappearance of cash a real risk with CBDCs?

“I have yet to see any government put out a CBDC in the effort to completely eradicate cash,” says Lassiter. “I don't see any space in my lifetime where a digital dollar replaces a paper dollar. In fact, the majority of the work has been centered on [CBDCs] being complementary to cash.”

Privacy and other concerns with a CBDC in Canada

While Canadians can be fairly confident that cash will remain, they have many privacy concerns when it comes to a CBDC, including potential for fraud (56%), risk of cyber attacks (53%), and, notably, lost control over personal finances (39%).

Canadians may recall when the federal government froze the bank accounts of some Freedom Convoy protesters in Ottawa last summer, after they occupied the downtown core for three weeks. The government was able to do this without a court order under the Emergencies Act, but it didn’t come without heavy criticism and a subsequent national inquiry. It’s possible Canadians wonder whether a CBDC, because it’s government-issued, could give the government similar power over their finances.

Privacy concerns around CBDCs aren’t unique to Canada, either. In 2021, for instance, the European Central Bank (ECB) ran a similar public consultation on a digital euro, and privacy topped the list of respondents’ values.

While a CBDC could make monetary transactions more secure and transparent, there are still important questions to be asked around privacy and the potential for fraudulent crime, such as identity theft.

“These are long-standing risks that we currently face today without a CBDC,” says Tombe. “Right now, we address those concerns by having financial institutions insure you. One could easily imagine that similar arrangements could be made for any new payments infrastructure.”

Freiman worries, though, that a CBDC could have unintended repercussions. And he’s not alone. Some 41% of survey respondents say they’re concerned about “unpredictable consequences” with the introduction of a digital currency.

“The biggest concern is that gradually, a future government would have access to the transactions of citizens,” says Freiman. “And that would be a nightmare for democracy and civil liberties, and potentially for human rights.”

“I'm afraid that even if we adopt this kind of technology, we won't be able to create restrictive mechanisms that would prevent the government from eventually abusing its powers.”

51% of Canadians somewhat confident the BoC will protect privacy if a digital dollar is launched

Despite their concerns, 51% of Canadians are somewhat confident in the Bank of Canada to safeguard their privacy if a CBDC is ever implemented.

“If we adopt some kind of digital dollar, then part of the solution must be that you don't even need to trust the central bank not to share your data with others,” says Freiman. “It should be technically impossible for them to do so.”

Confidence in the BoC aside, more than a third (35%) of Canadians are concerned about lack of anonymity/surveillance with a CBDC — for instance, transaction tracking.

“These concerns around privacy are incredibly valid,” says Lassiter. “If we get it right, we could actually enhance privacy protections that we have in place today. But if we get it wrong, it could become a tool for intrusion and oversight.”

But, she adds, concepts of privacy, anonymity, and security are nuanced. “Anonymity and privacy are two very differently defined terms. You can have anonymity in certain parts of a transaction and privacy in other parts of a transaction; it’s not really a binary choice. But almost never do you have full anonymity in any transaction.”

Canadians might be surprised to learn that transaction tracking already happens today. When you purchase something using your debit or credit card, Payments Canada initiates a message, similar to a text message, that says who you are, who the merchant is, and what the transaction value is.

“Of course, we have regulations and rules that ensure privacy is respected in those cases,” says Tombe. “But CBDCs themselves don’t come with any uniquely difficult risk [in this regard].”

Possible benefits of a CBDC in Canada

Survey respondents were asked via an open-ended question what benefits they saw with a CBDC. The top responses were related to:

- Convenience: Many respondents mentioned the convenience of digital transactions. They highlighted the ease of online purchases and transfers between companies and people.

- Safety: Several respondents pointed out the potential for more secure transactions with digital currency, including the idea that one can't be robbed if they don't have physical money on them.

The BoC says a central bank digital currency may also be important for protecting the future integrity and stability of the Canadian economy. For instance, guarding against the rise of cryptocurrencies or the use of CBDCs from other countries.

Freiman agrees. “We can’t get to a place where other currencies are adopted in Canada,” he says. “Then we lose what we call monetary sovereignty.”

Currency that’s the liability of the central bank could also take a good amount of risk out of our financial system. "Most of our economy is filled with commercial bank money created through loans,” he says, "which means most of our economy is filled with risky money. But central bank money, or let's call it public money, is backed by the central bank and therefore more reliable."

Tombe echoes this sentiment. He says a CBDC could “de-risk your currency holdings as an individual,” pointing to recent U.S. bank failures that have raised concerns for Canadians around the safety of their own deposits.

A CBDC could also introduce some market rivalry. “The central bank would literally be competing with commercial banks for consumers’ deposits,” says Tombe. “Depending on what one thinks about the level of competition that exists in Canadian banking, maybe a little more competition is a good thing.”

Still, the Canadian public likely needs more information before they can properly weigh the pros against their concerns. The BoC’s public consultation is a start, but more conversation at the public level would help raise awareness.

“This is so much broader than the Bank of Canada,” says Freiman. “People from the financial industry don’t have the authority to consider the social implications of a CBDC. It’s up to the government and citizens to create a discussion about whether we actually need this.”

And Freiman wants to ensure that discussion is had sooner than later.

“Once the option is on the table and ready,” he says, “the undo button is very hard to press.”

Methodology

Data was collected via an online Pollfish survey of 1,500 Canadians ages 18 and older conducted between May 25 and 30, 2023. The estimated margin of error for a survey of this size is +/- 3%.

To help ensure respondents could make informed answers, WealthRocket included a definition of what a CBDC is in the survey terms and conditions, which respondents could click on prior to starting the survey.

Fair Use Statement

If you enjoyed our study on the prospect of a Canadian central bank digital currency, feel free to share it for non-commercial use. We ask that you link back to the original page so our editorial team receives credit for their work.

Inquiries