There’s no denying that the price of pretty much everything has gone up substantially. Food prices, in particular, have shifted so much that they’re no longer possible to ignore. Unless, of course, you’re running a self-sufficient farm and grow all of your own food. But that’s not exactly a feasible possibility for most of us.

How food price inflation is affecting our diets

- Written by

-

![A headshot of Rachel Cribby who is a contributing author at WealthRocket]()

- Rachel Cribby

Why you can trust us

The team at WealthRocket only recommends products and services that we would use ourselves and that we believe will provide value to our readers. However, we advocate for you to continue to do your own research and make educated decisions.

There are some things, though, with our regular-sized kitchens and small plots of land (or balconies), that the rest of us can do to cope with rising costs. Join us as we take a dive into the data behind food prices and attempt to seek out inflation-proof foods. Here are some things worth knowing about the rising cost of groceries and the rising cost of living in general.

In This Article

- Believe the hype—food prices have risen substantially

- Some food groups are hit harder than others

- Food price increase from 2021 to 2022

- There’s a lot going on behind the scenes

- Canadians eye cheaper diets, lifestyle changes

- More Canadians are moving to food banks

- It (maybe) won’t be this way forever

Believe the hype—food prices have risen substantially

The high cost of food prices seems to be a point of conversation for everyone lately. It’s not just chit chat. There is very real data to back it up.

Although overall inflation is officially at 7.7%, the highest increase since the early 1980s, food prices saw an increase of 9.7% between April 2021 and April 2022. According to the Food Price Report, food prices in Canada have risen a staggering 77% since the year 2000. There is no doubt that it has become harder for the average Canadian to budget for food for themselves and their families.

To put it into another perspective, the report found that the average Canadian family would need to spend nearly $1,000 more per year to buy the same amount of food that they bought in 2021. Unfortunately, as 2022 continues on, it’s predicted to only get worse.

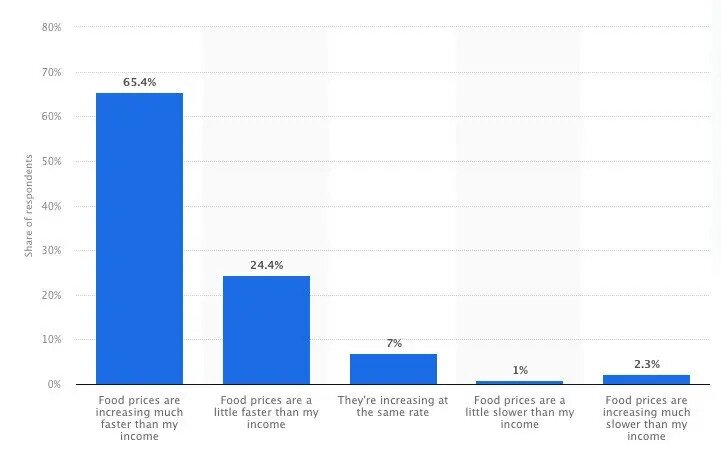

How do you think prices are increasing compared to your household income?

Source: Statista

Some food groups are hit harder than others

Good news for our cravings but bad news for our general health: healthier foods are hit the hardest by these price increases. This is usually what happens and is one of the reasons why we usually see success among the fast food industry during a recession.

The Food Price Report predicts that the highest food price increase will be seen across fresh food items including dairy, bakery, and produce. Somewhat surprisingly, the lowest increases are predicted to occur among the meat and seafood categories.

While we might not feel the impact of a population with a poor diet right away, experts warn that we could eventually see a strain on our healthcare system. Even before the price increases, up to 71% of Canadians did not eat enough fruits and vegetables. A worrying fact when diet-related diseases are a major concern for Canadian health.

As the chart below shows, packaged products are not immune from price increases. However, the majority of the items are fresh, healthy items, and, as we mentioned above, fruits, vegetables, and bakery items. Experts are currently studying the relationship between inflation and obesity rates.

Food price increase from 2021 to 2022

| Item | Increase between 2021-2022 (%) |

|---|---|

| Edible fats and oils | 28.8 |

| Pasta products | 20.6 |

| Condiments, spices and vinegars | 18.8 |

| Lettuce | 18.4 |

| Butter | 17.5 |

| Flour and flour-based mixes | 16 |

| Fresh or frozen fish (including portions and fish sticks) | 13.4 |

| Cereal products (excluding baby food) | 13.1 |

| Canned vegetables and other vegetable preparations | 13 |

| Apples | 12.7 |

| Fish | 12.3 |

| Bread, rolls and buns | 11.9 |

| Bakery and cereal products (excluding baby food) | 11.3 |

| Breakfast cereal and other cereal products (excluding baby food) | 11.3 |

| Coffee and tea | 11.3 |

| Preserved vegetables and vegetable preparations | 11.1 |

| Other fresh fruit | 10.8 |

| Other bakery products | 10.4 |

There’s a lot going on behind the scenes

We can establish the fact that groceries are getting more expensive but do we know why they are?

Yes, but it’s complicated. Labour plays an element—food service jobs (including jobs on farms and in factories) have proven hard to fill as the pandemic rages on. Reasons for this include safety concerns, lack of pay and benefits, and the overall instability of the industry.

In addition to labour shortages, the supply chain also plays a factor. The phrase “supply chain” has become a buzzword since the start of the pandemic and for good reason. Statistics show that over half of agricultural businesses had trouble obtaining supplies both domestically and internationally.

Some of the reasons for supply chain disruptions include the closing and opening of international borders, restrictions that limit the movement of people and goods, and the string of businesses closing and re-opening. Climate change-related extreme weather events also play a factor. Another impact at play is the effect of the virus on workers, who were vulnerable to getting sick from the start of the pandemic.

Canadians eye cheaper diets, lifestyle changes

Canadians are responding to the rising food prices by changing their diets. In fact, we’re already seeing Canadians turn towards less healthy but cheaper options as a means of dealing with the rising COL.

Instead of adopting a brand new diet or lifestyle, the most cost-friendly will likely be to shop the sales and try to ride the unpredictable waves of inflated pricing. Some outlets, like the New York Times, are already offering a library of inflation-friendly recipes.

More important than any diet or lifestyle change will be Canadians’ ability to shop the sales. While we may have had the luxury to ignore weekly fliers before and just “shop with our hearts”, many Canadians are re-discovering how shopping for deals and discounts can help their financial bottom line. Stats Can reports that half of surveyed Canadians report seeking out sales and promotions while buying food.

Unfortunately, it almost always costs more to eat a healthy diet than an unhealthy one. If Canadians are looking to buy what hasn’t been affected by inflation, they won’t be buying healthy foods. It’s no coincidence that three billion people around the world can’t afford a healthy diet. Although studies have shown that certain vegan and vegetarian diets are cheaper, it’s important to consider that these diets require more time and preparation which don’t make them viable for many low-income workers. It also might not be the case right now, as meat and seafood prices see the smallest price increases and vegetables are seeing the largest ones.

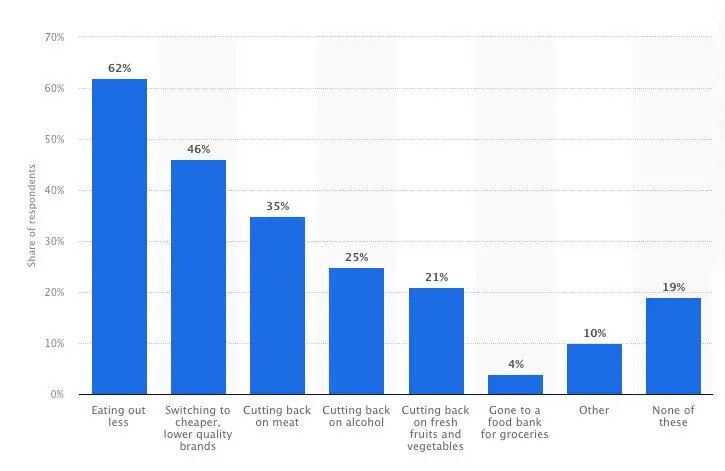

Are you or your household doing any of the following more than usual because of food prices?

Source: Statista

More Canadians are moving to food banks

Those who remain able to seek out these sales and promotions are the lucky ones. As wages continue to stagnate and prices continue to increase, more and more Canadians are turning to food banks to fill gaps in food security. Food Banks Canada predicts that 7 million Canadians went hungry between March 2020 and 2022.

The average food insecure household in Canada is employed and providing for a household on a single income. Food insecurity is most often seen among low-wage, part-time, and racialized workers. Inadequate wages drive the problem of food insecurity. On paper, just under 10% of Canadians are low-income, making them vulnerable to an increase in food prices.

It (maybe) won’t be this way forever

An increase in food prices is an added stress, so it makes sense to be looking for light at the end of the tunnel. Does such a thing exist? That depends on who you ask.

Some economists predict that inflation rates will even out by the end of 2023. However, other experts aren’t so sure that things will even out, and instead predict that we’re embarking on a “new normal” for the cost of goods. And this new normal might mean a lot of couponing and sale-shopping in all of our futures.

Rachel Cribby

Rachel Cribby is a professional writer, editor, and transcriptionist from Canada. Her personal finance work has been published in Greedy Rates and Forbes Advisor.