The world of cryptocurrencies is a heavily populated one. With more than 22,000 unique assets traded across 500+ exchanges, competing with each other for a fair share in a multi-billion dollar market, it may be confusing to find your way as an investor.

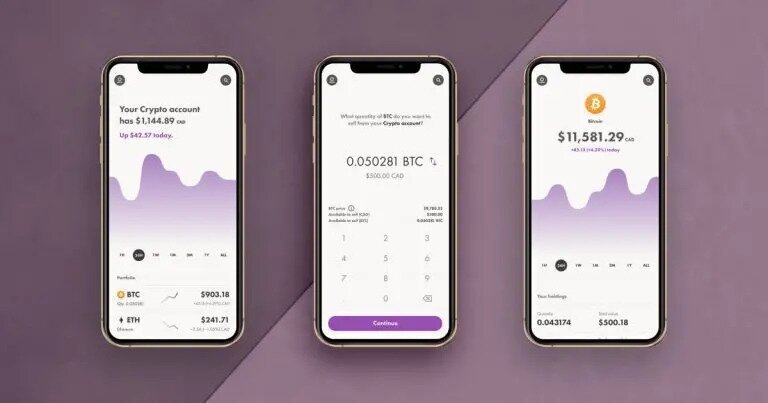

But what if you had the assistance of Canada’s first-ever regulated crypto platform by your side? Wealthsimple Crypto makes it easy to invest in the crypto space. In this Wealthsimple Crypto review, we discuss how the platform functions, how you can sign up, the pros and cons of buying crypto on Wealthsimple as well as safety features.